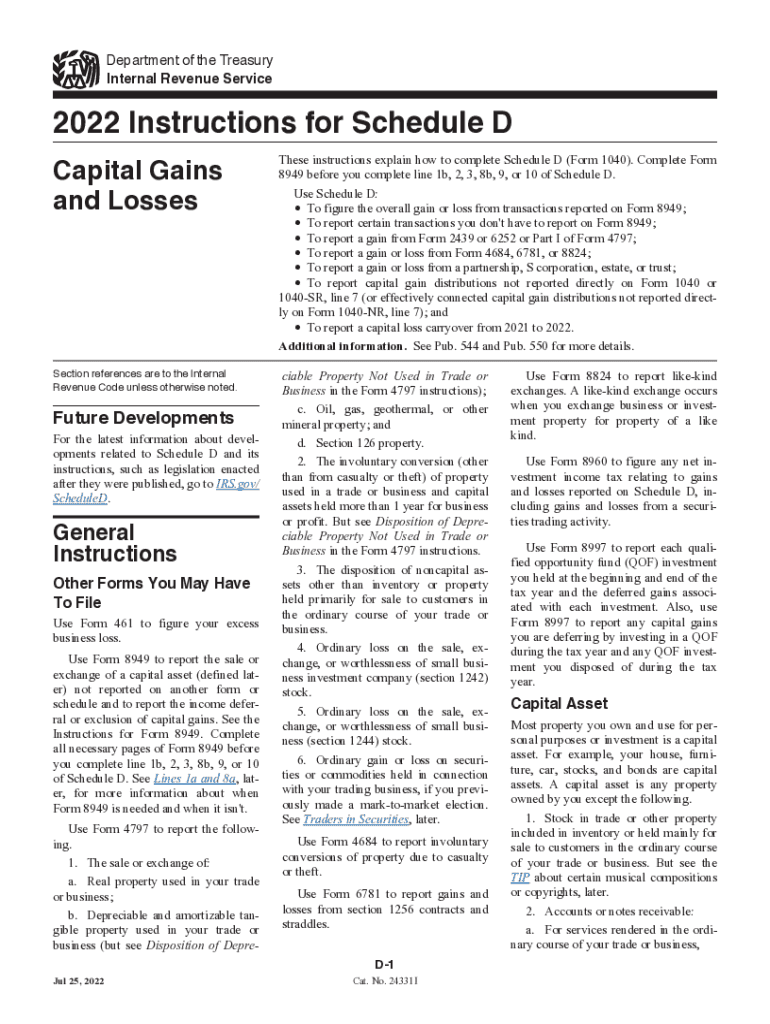

Instructions For Schedule D 2024 Form – Form 8949 must be filled out before you can move forward on Schedule D. The instructions for Form 8949 are included with Schedule D instructions for 2011. Complete Part I and Part II of Form 8949 . Usually, annual contributions to any individual above a certain threshold ($18,000 in 2024, up from Internal Revenue Service. “Instructions for Form 709 (2019) Schedule A. .

Instructions For Schedule D 2024 Form

Source : www.irs.govIRS 1040 Schedule D Instructions 2022 2024 Fill and Sign

Source : www.uslegalforms.com2023 Instructions for Schedule D (Form 1041)

Source : www.irs.govCapital loss carryover worksheet 2022: Fill out & sign online | DocHub

Source : www.dochub.com2024 Tax Update and What to Expect

Source : sourceadvisors.com2023 Instructions for Schedule C

Source : www.irs.govSchedule D 2022 2024 Form Fill Out and Sign Printable PDF

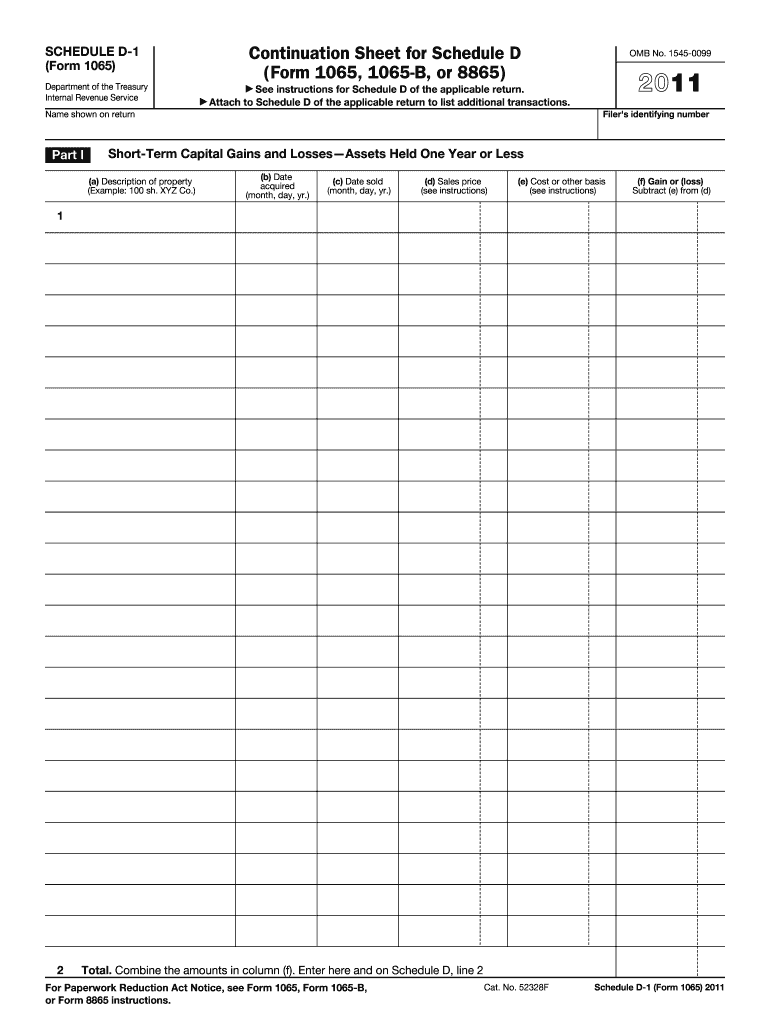

Source : www.signnow.com2011 2024 Form IRS 1065 Schedule D 1 Fill Online, Printable

Source : www.pdffiller.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comInstructions For Schedule D 2024 Form 2023 Instructions for Schedule D: If you decide midway through your online tax return that you’d rather and instructions for filling out a wide range of common tax forms. Learn more in our full review of Tax Act 2024. . Taking the deduction for property you sold can get tricky, however, because this involves either Schedule D or Form 4797 study the 10-page Instructions for Form 4797, or hire an accountant .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)